Horror Vacui

The mariner of the 16th century gazing at a chart of the world’s oceans would have cast his eyes on drawings of mythical sea creatures, various gods of the deep, and assorted depictions of the unknown. These embellishments were a convenient way for cartographers of that era to “fill in the blanks” for - just as nature abhors a vacuum – map makers abhorred empty spaces.

Over the next century or two, coastlines were rigorously charted; rivers and estuaries sounded; islands discovered; and even the mysterious southern ocean divulged its greatest secret – Antarctica. Eventually, the efforts of determined explorers, fearless seafarers, and intrepid souls from all walks of life cast Horror Vacui aside with their detailed discoveries.

Today, the vessels that call upon the ports of Texas are supersaturated with information every moment of their voyage. Hence, there is very little that is not known; even the shroud of fog is penetrated by radar and the AIS signals from ships navigating amidst its gossamer veil. More importantly, the cargoes transported aboard those ships are fastidiously tracked as part of the just-in-time commercial continuum. In essence, one knows what has been shipped and what has been ordered.

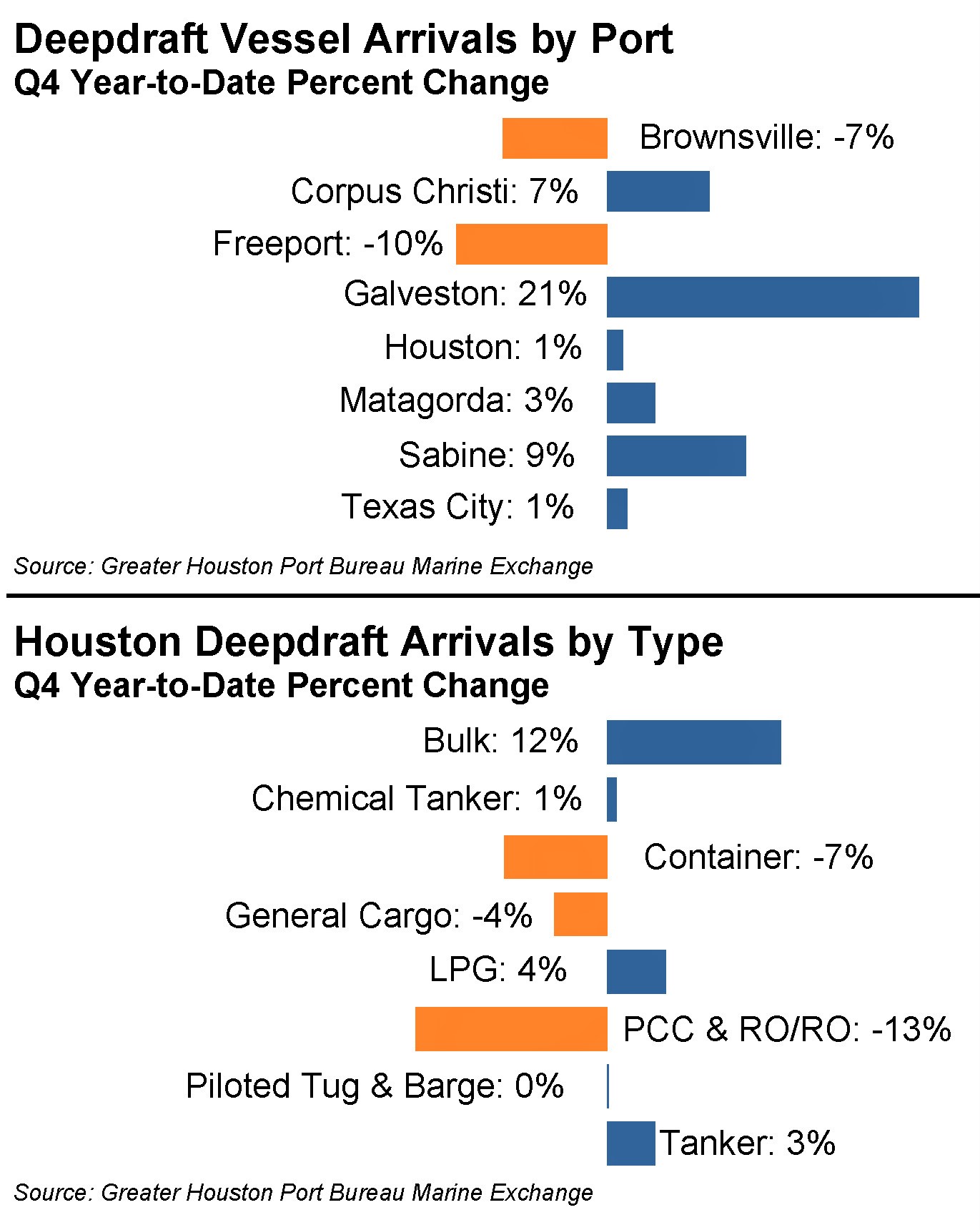

With the closing of the books on the 2022 arrival tallies last month, there is a clear picture on the state of maritime commerce in Texas. It is alive and well! 2022 outshined 2021 by 4% on the blue water front and 10% more tows transited across the Houston Ship Channel over the last year. Only two ports – Freeport and Brownsville - reported a vessel-arrival percentage decline in 2022.

With the closing of the books on the 2022 arrival tallies last month, there is a clear picture on the state of maritime commerce in Texas. It is alive and well! 2022 outshined 2021 by 4% on the blue water front and 10% more tows transited across the Houston Ship Channel over the last year. Only two ports – Freeport and Brownsville - reported a vessel-arrival percentage decline in 2022.

Freeport experienced the most pronounced decline at 10%. After impressive gains in 2021, LPG and tanker arrivals dropped by 22% and 21% respectively. Given that LPG traffic comprises the largest category for the port, the cumulative impact would have been more significant but for the 8% increase in chemical tankers – the port’s 2nd busiest category. Meanwhile, Brownsville’s numbers tailed off by 7%, primarily due to double-digit percentage drops at both the general cargo and liquid carrier docks. Yet, the port’s most active category, heavy lift, ended the year 15% higher than the prior one.

On the opposite end of the performance spectrum, the Port of Galveston grabbed top honors with a year-over-year 21% jump in arrival counts. An astounding accomplishment given that every vessel category – save one – lagged 2021’s count. Passenger vessels (cruise ships) logged a jaw-dropping 20-fold increase from 2021 to 2022. A COVID-weary population has enthusiastically embraced returning to the high seas aboard floating resorts. What Texas City lacked in cruise ships, it more than made up for in chemical tankers – a category that accounted for 54% of the port’s total blue water vessel calls. Surprisingly, the 13% rise in this category only resulted in a 1% uptick which was offset by the 7% wane in oil tanker arrivals.

Sabine, on the other hand, witnessed year-to-date gains in nearly every major vessel category. The port’s two most-seen hull types, oil tankers and LPG vessels, were up 4% and 12% respectively. Bulkers and general cargo also saw impressive gains in 2022 - to the tune of 27% and 25% respectively. Overall, Sabine finished the year with the 2nd best performance of the Texas ports with a 9% climb and further solidified its position as the 2nd busiest Texas port vis-à-vis vessel traffic. Corpus Christi’s ship count did not eclipse that of Sabine, but things also perked up during the year by 7%. Its bulk and general cargo arrival stats were off by 19% and 60% respectively. Nonetheless, the port’s biggest customer – oil tankers – which comprise 50% of its total blue water throughput, outpaced 2021’s arrivals by 10%.

Houston, by far the State’s most active port, did not match the year-to-date percentage gains of either Sabine or Corpus Christi. Yet, the modest year-over-year 1% uptick is more significant than it appears on its face. Specifically, 7% fewer (i.e., larger) container ships transported 14% more TEUs – nearly 4 million to be more precise. Conversely, car carriers calls plummeted by 26% due to the supply-chain hangover that left many a car lot barren. The BTU triad of tankers, LPG and chemicals eked out gains of 3%, 4% and 1% respectively. General cargo activity slipped by 4%; however, the year’s darling was the bulkers which outpaced last year’s calls by 12%. This bounty of bulkers facilitated a 45% increase in general imports at Port Houston terminals. All in all, 2022 was a welcome return to normalcy after nearly 2 years of pandemic-induced turmoil.

Just as Columbus’ crews feared what lay beyond what was known, many an economist was faced with ignotum per ignotius when contemplating a post-pandemic world. As evidenced by what has unfolded across the Lone Star State’s waterfront in 2022, consumers and businesses are resilient and are recouping what was lost. Nevertheless, with talk of recession, European energy shortages and saber rattling in the South China Sea, 2023’s future certainly remains uncharted.

About the Author

Tom Marian is the General Counsel of Buffalo Marine Service, Inc. He also serves on the Executive Committee of the Port Bureau Board of Directors.